Minimum Guarantees — A Guide for Financial Institutions

On behalf of the Sustainable Investment Forum Poland (POLSIF), after months of intensive work and exchange of experiences, we are pleased to present the result of the work of the Working Group on Minimum Guarantees, operating within our organization, whose aim is to promote knowledge and best practices in the area of sustainable development.

The Working Group consisted of experts representing the largest financial institutions in Poland. During the work on this study, the current legal regulations, guidelines and practices used by banks to date were taken into account. The objective of the Working Group was to develop an approach to the minimum range of issues that any institution seeking to meet the minimum guarantee criteria should take into account. The experts who worked on the survey aimed to convey information to clients in the most transparent way possible, explaining how minimum guarantees should be understood and what they can expect from financial institutions in the process of granting financing.

In the course of the Group's work, various ways of incorporating the concept of minimum guarantees in the processes of financial institutions were discussed. It has been established that the survey is not the only form of examination of minimum guarantees used by banks. Depending on the specifics of financial institutions and the nature of the transactions or clients financed, more extensive surveys or statements are also used that take into account the specific risks associated with the clients' activities.

Therefore, the survey presented should be seen as a kind of roadmap to help financial institutions and other stakeholders in their further work. This survey does not constitute a single market standard, but a basis for further individual work on the policies of banks and their customers.

We are confident that our joint efforts will contribute to greater transparency and understanding of financial processes, which will benefit both customers and financial institutions.

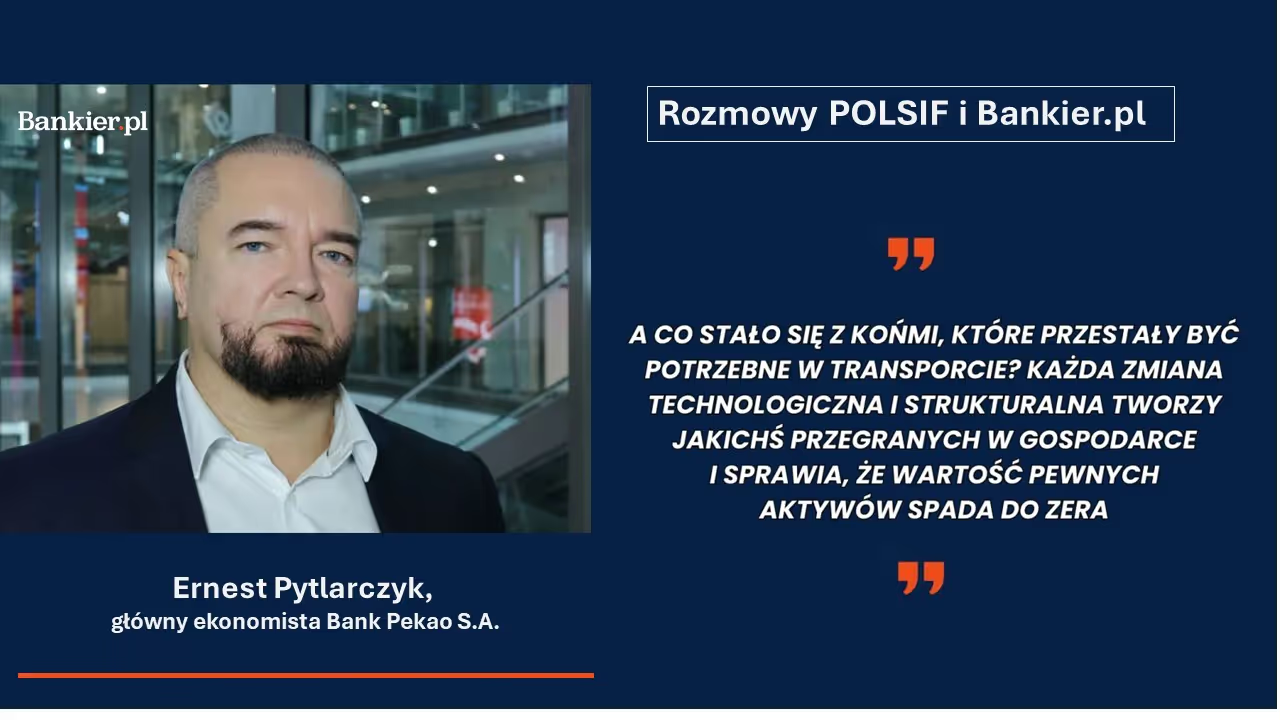

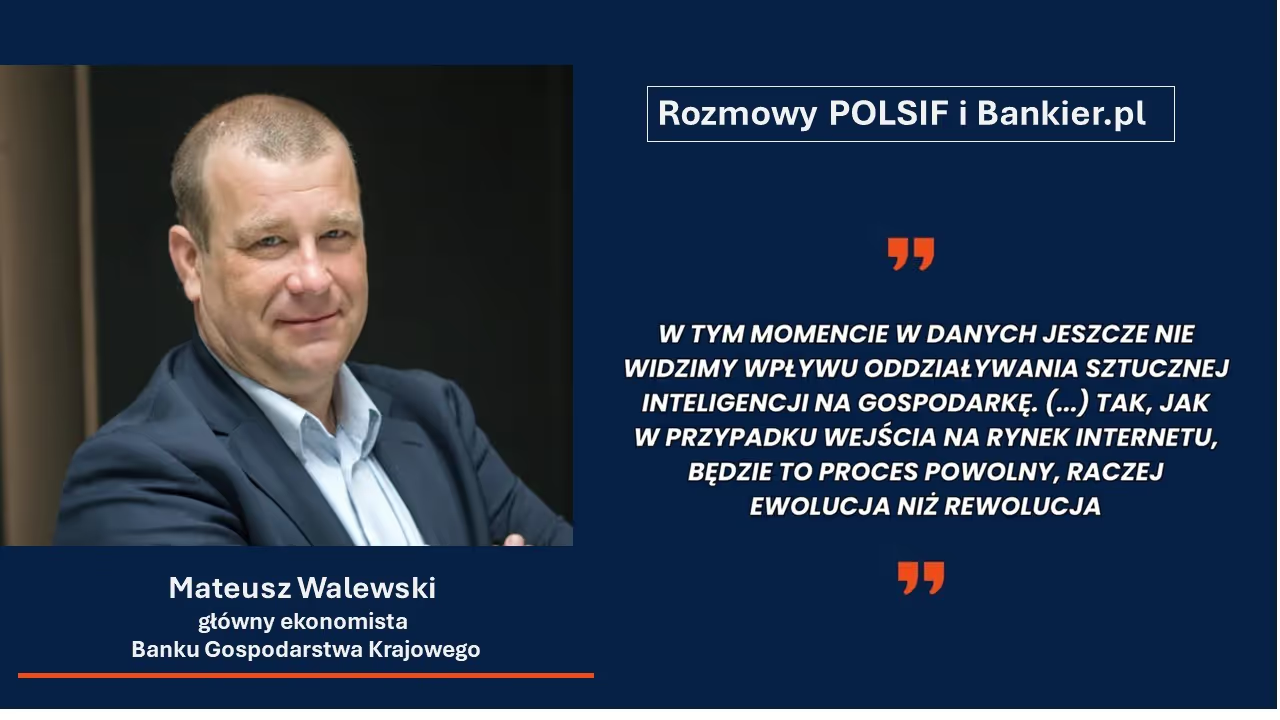

Our sincere thanks go to all those involved in this work, and in particular to the coordinators Joanna Alasy CFA, ACCA and Beata Pniak from ING BSK, as well as to experts from institutions such as EBRD, mBank, Pekao S.A, Santander Bank, PKO BP, BNP Paribas, BGK, Credit Agricole, Abris Capital Partners, Amundi and Bank Millennium.

.webp)